![]()

Yesterday Nike held it’s Fiscal Year 1Q 2017 conference call and report and as I’ve been discussing for a few years when I began seeing the disappearance of mom and pop accounts, they pushed off the worst year on the stock market they’ve ever had by leaning heavily on their path to DTC. Their conference call finally made clear to Wall Street that Futures were no longer the catalyst for growth. This reignited confidence in the brand and for the first time all year Nike is trending up on the market. I don’t see it slowing down as the brand doubles down on releases like the Hyperadapt and their “Express Lane” feature to streamline the release of footwear as they did with the Lunarcharge.

What does this mean for the market overall. I see Nike as a California styled company. What I mean by that is California is typically the first state to implement ‘certain’ changes. After that other states follow. Nike’s ability to adapt to the market by focusing on DTC keeps them in line with their growth being similar to a start-up even after 50 years. If Nike with their size can pivot, smaller companies should be able to follow suit and I know they will. Which means Nike wins, brands follow, but who loses?

This is Part 1 on the companies who will lose due to Nike’s rebound yesterday.

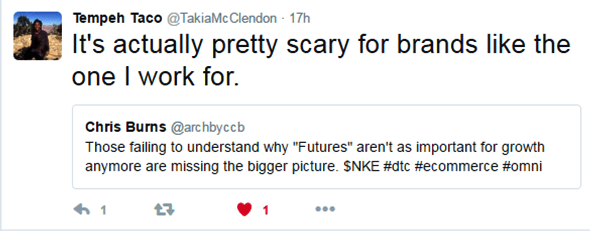

Specialty Stores – While I was celebrating my vindication of explaining why Wall Street was wrong, I got a tweet

My initial response was to the word brands. Why would a brand be afraid? I wrote back and she explained that she meant she works for a specialty running shop. It hit me like a brick. I attempt to cover small brands, and I even wrote a post about Saucony’s fantastic support of small shops.

Nike’s success is an indirect continuation of what I’ve seen happen in the disappearance link above. About three years ago I began seeing store closures in the Memphis area. I used to travel a radius of 5-8 hours to collect footwear for my online shop and the shops I had been hitting for years began dropping. The way it started was the store would be bombarded with Jordan Brand footwear that didn’t sell very fast. The stores had to purchase these items to get the more popular retro releases. When they couldn’t keep up with the purchases, then Jordan Brand would hold the retros hostage. Where in the past mom and pops could pay quarterly in some instances, they were now being forced to pay ahead of time for Futures, but they still had a ton of inventory that wasn’t moving even after deep discounts. Nike changed their MAP policy and stores couldn’t advertise Nike/Jordan sales. Slowly those stores began to tell me that they couldn’t keep their Jordan accounts without remodeling their stores to meet Jordan Brands’ approval. 1 store disappeared, then 2. Then a whole chain disappeared The Athletes’ Foot was literally gone overnight in Memphis 3 stores to 0 a few years back.

What I finally recognized was the real move was when a store chain that had 7 stores in North Mississippi contracted to 5 stores and told me that Jordan allowed them to RTV. The owner was excited. He had remodeled his stores and Jordan allowed him to move product and basically reset. As excited as he was, I told him that something was up. I forgot about it. This past January that 5 store chain sold to a larger chain. That’s when I connected all of the dots and did this video.

Why Are Retailers Like Finishline And Mom and Pop Shops Going Out Of Business: The Nike Effect – YouTube

I realize that Finish Line is not a mom and pop but they were also closing stores. The Nike Effect could be connected to the bankruptcy of The Sports Authority if you look hard enough, but that’s a different story. This is about Specialty Stores.

When the tweet above came back to me I stopped cheering and sat down to write this. When Nike wins, someone loses, but it doesn’t have to be that way. According to Tempeh Taco their shop has seen a decline and it started in 2014. What I’m sure happened was the store had to begin competing with brands who are marketing in the same spaces (Social and Direct). As brands begin doing this the store faces a more difficult time selling product. If a customer can get a shoe at 50% off from the manufacturer, how do you compete?

I immediately said that personalization would be the key. That doesn’t cover it. I have an e-commerce store and I know first hand that customers will buy online before they will get in their car and visit a specialty shop. Specialty shops are for true runners. It’s a niche that relies on brands to get people into the stores. What then is the solution?

ARCH. I stopped running ARCH Footwear this year to focus on consulting and making this website and network more informative. I stopped primarily though because I was paying for everything out of my pocket. A specialty store has something I never had. They have an e-mail list of loyal customers who will get behind the shop and support them. When you consider that major store chains are creating private labels, you have to recognize what is about to happen in retail. If I had a specialty store I would spend the next few weeks developing a private label. If one guy (me) can launch a brand (albeit the wrong way and in reverse) a specialty shop can drive traffic with a lightweight trainer that they could jumpstart via Kickstarter or Indiegogo. I mean think about this, an unproven retail model with a Nike knock-off wool shoe garnered a 2 million dollar investment because of a successful Kickstarter. Think about what a specialty store with knowledgable staff and bloggers like Takia McClendon could do if they decided to spend time working on a private label.

While Nike winning creates a temporary feeling that someone must lose, when you stop and look at their gains a smaller company can adapt and win also. If a company is having a difficult time figuring out which way to go, call me, e-mail me, it’s why I stopped and focused on this site. I will give you the steps.

Part 2 When Nike Wins, Who Loses? Part 2: The Brand that Loses with Nike’s Big Win…Starts With a U

Part 3 When Nike Wins, Who Loses? Part 3 – Retail Stores Not Named Foot Locker