![]()

Source: Nike Internal / 2017 NIKE, Inc. Investor Meeting

Andy Campion opens the afternoon by reinforcing the fact that Nike is the #1 consumer brand. (This has to be in response to the multiple reports discussing adidas jumping Jordan.)

Summary of Key Points and deeper perspective:

- Growth is never linear. During dynamic times many feel that they need to do anything possible to change. Nike believes when it’s tough you do the right thing. What matters most? The consumer tells you through words and actions. Consumers are saying they want to be more connected, they want more innovation… faster. VaporMax went from launch to the top selling running shoe in months.

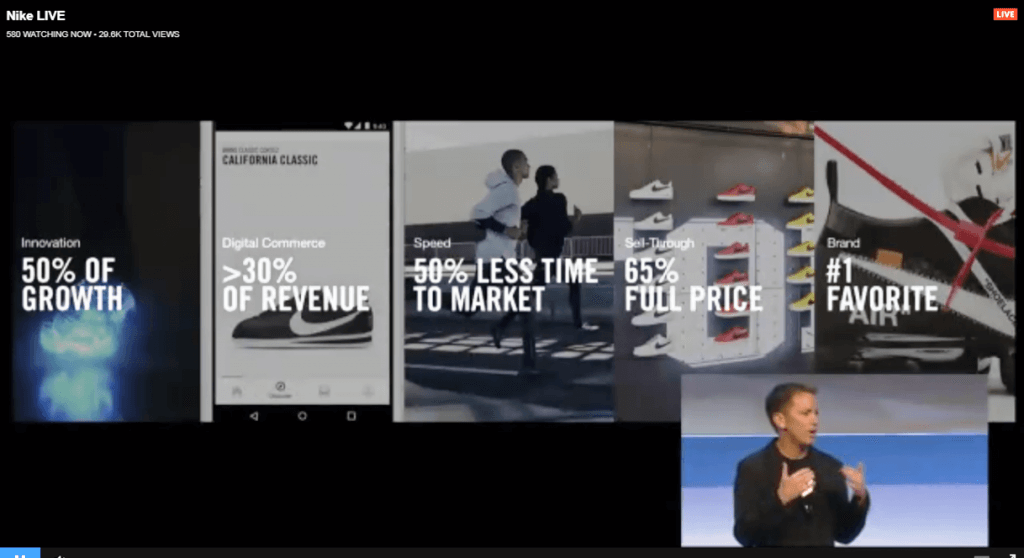

- Consumer Direct Offense shifts from the past to the future of retail. Driving change is easier said than done. 2X Innovation breakout showed the innovation pipeline with Vapor Max, React, Air. The relaunch of Nike.com is evidence.

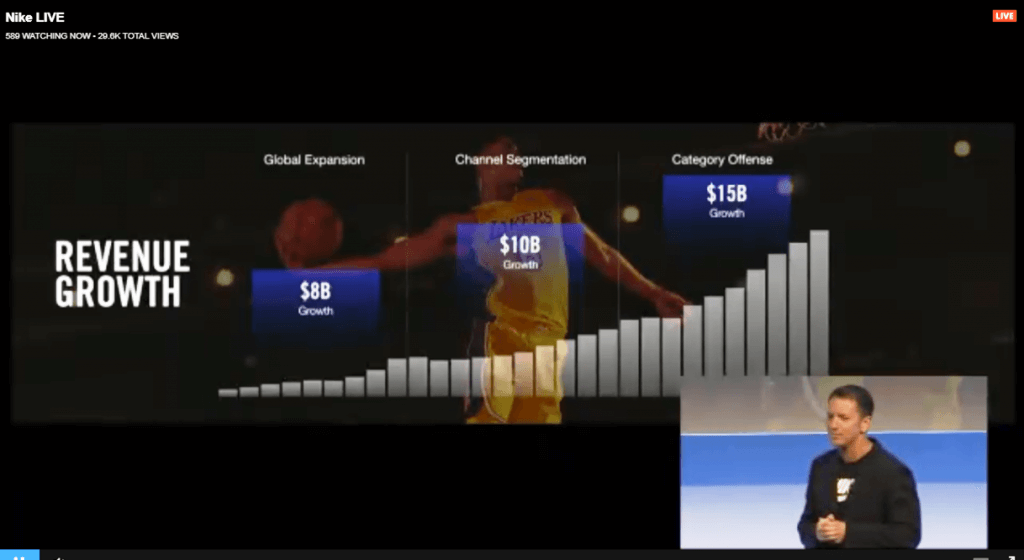

- Revenue Growth – now is the time to make changes. During this time Andy discussed the layoffs in the 80s and 90s without actually saying “layoffs”. In the 90s Futures drove growth. Today Digital disruption is an opportunity igniting Nike’s next period of growth.

- Operational Key Measures of Success – The 5 most important: 1. doubling impact of innovation 2. growing digital commerce (owned and partnered) digital will drive over 50%. 3. Digital will eventually drive more of the business via AR and other techs. Double speed to market 4. Leverage Triple Double with 65% of full price sell through 5. Ensuring Nike is the number 1 brand in the 12 Key Cities which will fuel 80% of revenue growth.

- Long Term Financial Model – Growth will be amplified by digital. Investment will overindex to digital. Nike will build it’s own projections. This means no more outside analysts which makes sense. Nike is leveraging a new marketplace framework which will shape their growth algorithm which will perform better than 3rd party wholesale. Nike will consider risk from macro to industry.

- North America – Nike expects to grow because right now undifferentiated wholesale retail has 65%, but Nike expects that to shift and Nike will own 80% of their business. They see that Nike will be affected by store closures, but that will have a low impact on Nike. Nike is already discussing Fiscal19 (next year). (This is telling as it speaks directly to adidas’ growth at retail. UA’s failure with Curry 3 was a blessing in disguise)

- International has 55% of the market available (may be wrong). Nike sees them expanding. Leading the way is China. Sport participation is increasing and distribution has leapfrogged a lot of the issues in the US in shipping.

- EMEA – Nike is the number 1 brand in all 5 of the key cities in this region. Nike will roll out NDC and mobile apps and investing into local tech in the region.

- APLA will benefit from an emerging middle class and the growth of sport. 3 of the key 12 cities are here. Tokyo, Mexico City and Seoul. Nike has untapped opportunity to grow there in Football, Women’s, Basketball and Jordan.

- Gross Margin Expansion – Faster growth when compared to 3rd party wholesale. The shift has a favorable impact. Price value is enhanced via CDO and Edit to Amplify. Product cost will be better. (I see this as a possible decrease in price!) Nike will have Better supply and demand and stronger full price sell through.

- Brand marketing, product innovation and digital technology and talent to scale will be where the direct investment is happening. (this sounds like they may be moving their digital from AWS) They are looking to acquire businesses in AI, Digital Product and other techs. (Nike is going silicon valley. This is a Wal-Mart strategy).

- Past 5 years Nike has increased returns to shareholders. 25-35% share ratio.

Q & A Session after Andy Campion. Amazing presentation overall and speaks directly to everything I’ve been writing for the last few years. There are definitely questions with some of this information especially in how Nike will handle their relationship with Amazon. I see the fact that they host their sites on AWS as a major issue especially with all of the innovation taking place. As Amazon becomes more aggressive in creating private labels the amount of information available to Amazon is potential issue for Nike.

Notes: Avoided a question on Full Price sell through today (right now).

Nike Direct is a direct reflection of Foot Locker Stock Locator

Nike does see retail store closures as a disruptor of growth.

Nike believes athletes are powerful influencers. They discuss Neymar and Ronaldo. Using other influencers: Abloh, Tisci will factor in to stay tapped in with the kids.

Great question on how will Nike increase speed in China. Nike has a source space in China in Shanghai.